Table of Content

The Employees State Insurance Corporation, popularly known as ESI, is a statutory body that was established under the Employees’ State Insurance (ESI) Act 1948. It is administered by the Ministry of Labour and Employment. The primary objective of this scheme is to provide social security in the form of health benefits to all employees listed in the organised sectors by offering them medical and financial assistance during difficult times.

The primary factors are the number of workers employed in your organisation / establishment and their gross wages/salary. If you have 10 or more employees (20 in some states) on your payroll, and they earn a gross monthly salary of or below ₹21,000 (₹25,000 for employees with disability), then you are obligated to register for ESIC. This holds good for a wide array of sectors, including factories, hotels and restaurants, road transport, education institutes, private medical facilities etc.

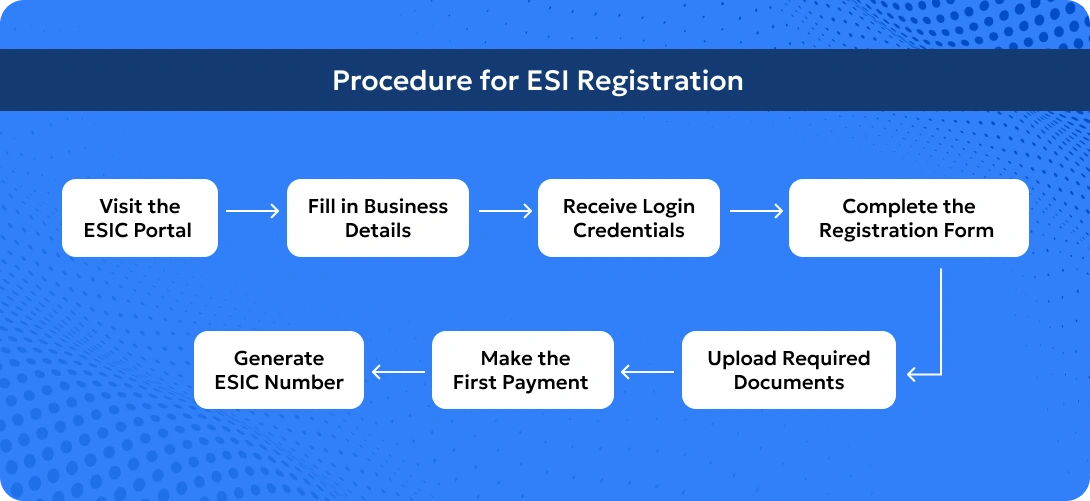

The following the step-by-step guide on how to register ESIC for employer could be followed as it is fully online and can be completed through the ESIC portal.

In our journey of over 30 years, we have helped multiple organisations benefit from our PF and ESI management services, including handling employee accounts, managing withdrawals and transfers, and ensuring on-time processing of ESI claims. Our expertise guarantees that employees receive maximum benefits while helping our clients, the employers, navigate the complexities with ease.

See Related Blogs

BLOGS

Fill in your details to download our exclusive e-learning document.

Fill in your details to download our exclusive e-learning document.

Fill in your details to download our exclusive e-learning document.