Table of Content

Have you ever thought about what would happen if your establishment suddenly received an ESIC notice?

For many employers, ESIC non-registration is not intentional. It often happens quietly while the business is growing, hiring rapidly, or restructuring payroll. But when enforcement begins, the consequences can feel sudden and overwhelming.

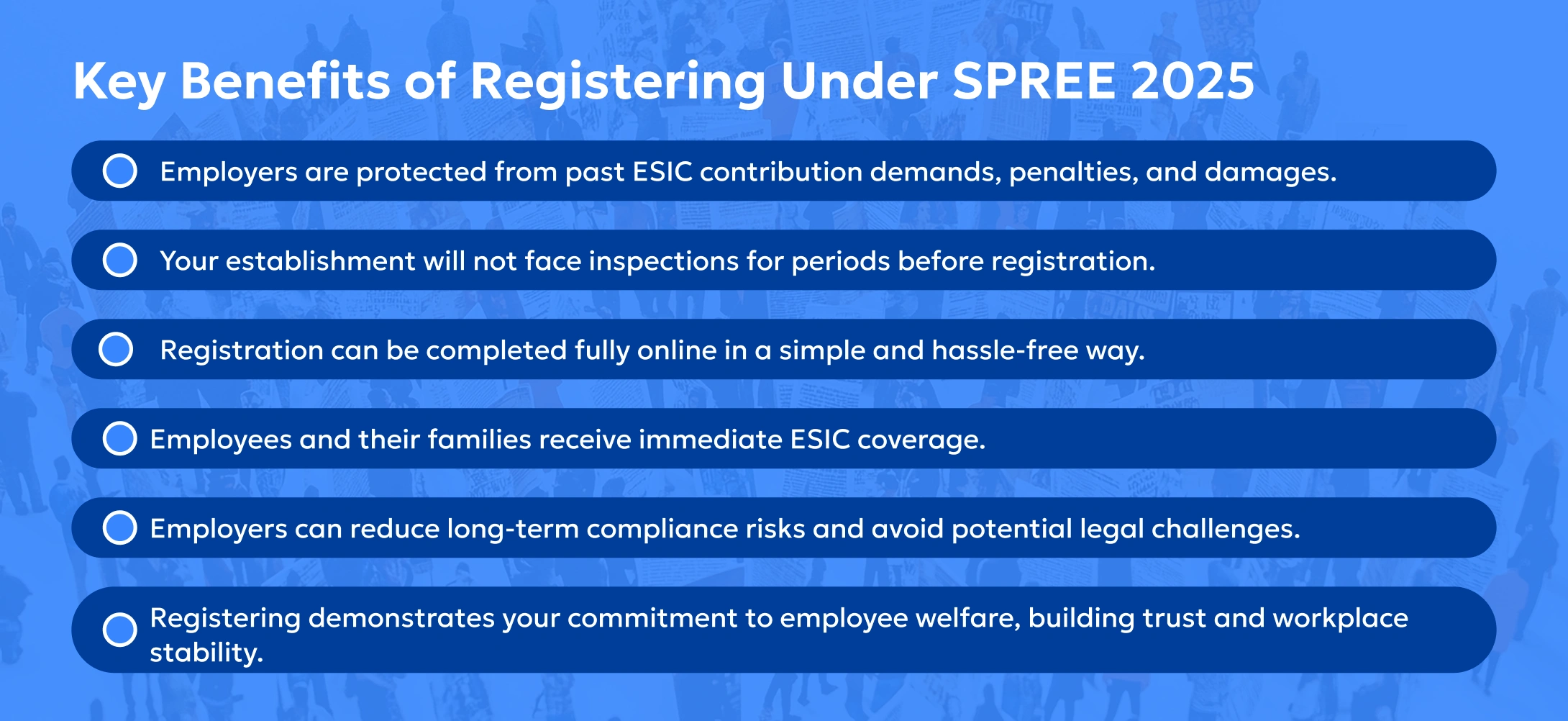

This is where SPREE 2025 becomes relevant. Introduced by the Employees’ State Insurance Corporation, SPREE 2025 gives employers a one-time chance to register under ESIC without facing penalties or past contribution demands. The idea is to encourage voluntary compliance while extending social security coverage to more workers.

In this blog, you’ll understand what SPREE 2025 is, who should register, important deadlines, wage compliance rules, and how employers can move forward safely.

SPREE 2025 stands for Scheme for Promotion of Registration of Employers and Employees. It is a special initiative launched by ESIC under the Ministry of Labour and Employment. The scheme allows eligible employers to register their establishments and employees without any demand for past dues or penalties.

The purpose of SPREE 2025 is straightforward. ESIC wants establishments to come forward voluntarily instead of fearing inspections or retrospective action. The focus is on compliance correction and employee welfare, not punishment.

After this date, normal enforcement under the ESI Act will apply. That includes inspections, retrospective coverage, and penalties where applicable.

Knowing the deadline will help you as an employer to plan better. The next step is to understand whether your establishment and employees are eligible.

Add details of all eligible employees, including:

After successful verification, an ESIC registration code is generated for your establishment. This code allows you to begin regular contributions and enables employees to access ESIC benefits.

While the process may appear simple, mistakes during registration can create long-term compliance challenges. Taking the time to enter accurate wage and employee information is critical, especially in light of the updated definition of wages under ESIC.

Here’s how it works:

This rule prevents allowance-heavy salary structures designed to reduce statutory contributions. For employers, it means payroll structuring must align with compliance requirements.

Understanding this becomes easier when seen through real calculations.

When an employee’s salary structure follows the 50% rule, ESIC contributions are calculated mainly on Basic Pay and Dearness Allowance. In such cases, the employee contributes 0.75% of wages, while the employer contributes 3.25%.

If allowances and exclusions cross the 50% limit, the excess amount is added back to wages. This increases the ESIC wage value and results in higher monthly contributions. In simple terms, even if the basic salary looks low on paper, ESIC liability can still be higher due to add-back rules, making payroll structure a compliance matter, and not just a cost-saving exercise.

A manufacturing company in Karnataka deducted ESIC contributions from employees’ wages but failed to deposit the amounts with ESIC for several months. An inspection by ESIC authorities uncovered the default, and prosecution was initiated against the person exercising supervisory control over the establishment.

The employer argued that he was not the principal employer responsible for ESIC compliance. The case reached the Supreme Court.

Violations observed:

Outcome:

Consequences:

SPREE 2025 must be handled correctly the first time. Vishaal Consultancy Services assists employers with eligibility checks, accurate ESIC registration, and compliant wage structuring.

We help HR teams review contributions, reduce compliance risks, and stay aligned with ESIC requirements on an ongoing basis. Book a free consultation call or talk to our experts today.

SPREE 2025 offers employers a valuable opportunity to correct ESIC compliance without carrying the burden of past liabilities. It allows businesses to register cleanly, protect employees, and align with current labour law requirements. With clear timelines and updated wage rules, timely action becomes essential for long-term compliance stability.

If you need support with registration, wage structuring, or ongoing ESIC compliance, Vishaal Consultancy Services can help. Reach out to us to move forward with confidence and clarity.

No. If you complete registration within the SPREE 2025 window, ESIC will not raise demands, penalties, or inspections for periods before registration. However, this protection applies only to past periods. Ongoing compliance after registration must be accurate and timely.

It is risky to delay payroll corrections. ESIC contributions start immediately after registration, and incorrect wage structuring can lead to higher contributions, notices, or adjustments later. Aligning salary components with the 50 percent rule from the start avoids future compliance issues.

Yes. Registering later without SPREE 2025 can expose your business to retrospective coverage, interest, penalties, and inspections. SPREE 2025 offers a clean entry without past liabilities, making it a safer and more cost-effective option for employers planning ESIC registration.

See Related Blogs

BLOGS

Fill in your details to download our exclusive e-learning document.

Fill in your details to download our exclusive e-learning document.

Fill in your details to download our exclusive e-learning document.