Table of Content

What would you do if you ignored basic protections like medical or maternity cover for your employees and ended up in court?

In 2023, a small electronics company in Chandigarh learned this the hard way. The Chief Judicial Magistrate sentenced one of its senior partners to three months of jail and imposed fines under the Employees’ State Insurance Act. Their crime? Ignoring ESIC-mandated employee records and repeated inspection notices.

This wasn’t a big corporation. Just a regular business that failed to follow the law. Social security is not just about PF. It protects workers during illness, accidents, maternity, or even death. And when employers ignore it, the law doesn’t look away.

In this blog, we’ll explain:

Social security is a legal system that protects workers during key life events such as illness, maternity, disability, retirement, or death. It offers financial safety nets when income stops.

According to social security in labour law, employers in India must give certain benefits once their company becomes eligible. This includes monthly contributions, timely filings, and helping employees access these benefits.

At its core, social security in labour law ensures that when your workers face tough times, they are not left alone. And that your company is protected from avoidable legal and reputational risks.

India’s social security in labour law includes several important acts. Each focuses on a different type of benefit or life event. Whether your organisation is large or small, some of these laws may apply to you.

Here are the key ones:

If you’re running a business, you might be wondering whether social security laws even apply to you. Many smaller companies assume these rules are just for large corporations, but that’s not true. The moment your workforce crosses a certain size, these laws become mandatory.

Here’s a simple way to check:

Even if you’re operating a small team or business, once you cross these limits, the law applies to you. And if you’re unsure, it’s better to ask now than face trouble later.

It is easy to think of social security in labour law as just another compliance burden. But in reality, it builds a safer, more trustworthy workplace.

This social security in labour welfare framework extends beyond legal compliance. It promotes the well-being of workers and protects employers from unnecessary conflict.

Here is how it helps:

Incident:

In October 2023, the Chief Judicial Magistrate’s Court in Chandigarh sentenced a senior partner of a small electronics firm, to three months of simple imprisonment and a ₹3,000 fine. Why? Because they failed to maintain the required employee records under the Employees’ State Insurance Act, despite repeated inspections and notices from ESIC.

Violations:

Outcome:

The court ordered jail time for the employer and fines for both the partner and the company. The business also suffered reputational damage and legal expenses.

Compliance lapses like these can cost your company more than just money—they damage trust and reputation. If you’re unsure about where you stand, it’s time to get expert help and fix the gaps before it turns into a legal problem.

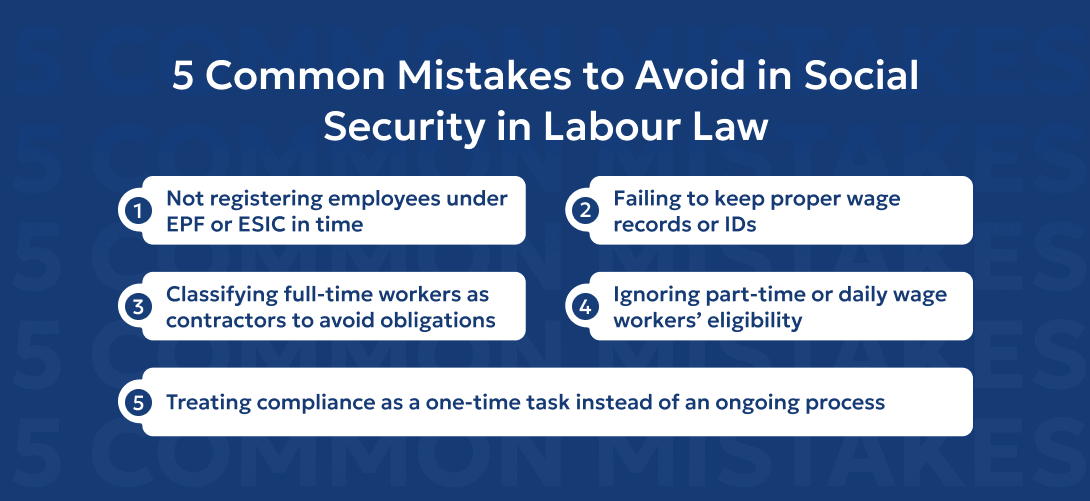

Social security compliance isn’t something you can afford to overlook. One missed step can lead to fines, delays, or even legal trouble. This checklist will help you ensure your company is meeting its key responsibilities under Indian labour law, especially in the area of social security in labour law.

Understanding the broader scope of social security in labour law is also important, as it goes beyond just employee benefits and extends to the overall welfare and protection of your workforce.

Staying consistent with your labour law obligations isn’t just a legal requirement. It builds trust with your team and protects your business from risk.

Vishaal Consultancy Services works closely with employers to ensure their responsibilities under social security in labour law are fully met. We do this without confusion or last-minute panic. We help simplify the legal side so you can focus on your team.

We assist with:

Social security in labour law is not just about following rules—it’s about supporting your team when they need it most. It builds a sense of care, stability, and trust in the workplace. And when done right, it also protects you from legal risks, delays, and unnecessary disruptions.

Vishaal Consultancy Services can guide you through every step of your social security compliance, including PF compliance and ESI compliance. Book a quick call with our experts today and take the first step toward building a safer, legally sound workplace.

See Related Blogs

BLOGS

Fill in your details to download our exclusive e-learning document.

Fill in your details to download our exclusive e-learning document.

Fill in your details to download our exclusive e-learning document.

What Does Social Security in Labour Law Mean for Employers?