Table of Content

For years, Indian employers and HR managers have been struggling with a confusing tangle of over 29 labour laws, each with different rules for wages, social security, leave, safety, and working conditions. Added state-wise variations made compliance even more complicated, leaving HR teams overwhelmed, and employees uncertain about appointment letters, benefits, wages, and job security.

This created stress, compliance risks, and gaps in worker protections, especially for those in gig, contract, fixed-term, or informal roles. But not anymore. The New labour code in India, effective 21 November 2025, consolidates all 29 laws into four unified codes. It simplifies compliance, broadens protections, and helps HR teams build a fair, modern, and legally secure workplace.

The Indian labour system needed reform because old laws were outdated, overlapping, and difficult for employers to follow consistently. The New labour code in India replaces 29 laws with four unified codes, making compliance simpler and extending protections to workers who were previously excluded.

The four codes are:

A key change is that wages are now standardised, which removes confusion around minimum pay, overtime, gratuity, and leave. The new rules also require basic pay to be at least 50% of the total CTC, which increases PF and gratuity for many employees. The code further extends legal protection to gig, platform, fixed-term, contract, migrant, and informal workers. HR teams must update payroll benefits, and employee records with accurate classification and documentation.

Let’s see how the new labour code affects minimum wages and wage payments, which directly impact payroll and employees.

The New labour code in India introduces a statutory minimum wage for all employees across both organised and unorganised sectors, with a national wage floor to avoid regional undercutting. Employers must pay all employees their monthly salary on or before the 7th of every month, so HR teams need to follow a strict payroll timeline. This applies to permanent, fixed-term, contract, and gig workers.

For HR teams, this means reviewing salary structures, updating payroll cycles, and checking salary bands to ensure compliance and accurate, timely payments.

Alongside wages, gratuity and social security are now more inclusive, covering more categories of workers, which is a significant change for HR.

Under the New labour code, fixed-term employees can now receive gratuity after just one year, instead of five. Social security is also more inclusive, covering gig, platform, fixed-term, contract, and informal workers with benefits like PF, ESI, and other welfare schemes.

As an employer, you need to update contracts, benefit structures, and contribution records. Proper documentation ensures your employees get their entitlements and protects your organisation from non-compliance.

Under the new labour code, every worker, including gig, contract, or platform roles, is now entitled to a formal appointment letter clearly stating employment terms, wages, benefits, and social security coverage.

For employers, this means reviewing onboarding processes and standardising offer letters for all employees, regardless of work arrangement. The goal is to ensure transparency, build trust, and maintain compliance with the law.

The Occupational Safety, Health and Working Conditions Code requires uniform safety standards across all sectors. Employers must maintain records, implement welfare measures, and ensure workplace health standards.

Under the new labour code, Annual free health check-ups are mandatory for workers aged 40 and above, and women can work night shifts with consent and proper safety measures. HR teams need to update safety policies, audit compliance, and adjust shifts to protect employees and improve workplace satisfaction.

The New labour code updates rules for layoffs, retrenchments, closures, standing orders, dispute handling, and trade union recognition. It also requires employers to complete full and final settlements within 2 working days when an employee leaves, so HR must clear dues and paperwork quickly.

For HRs, this means reviewing termination policies, updating redundancy processes, and keeping grievance procedures clear and organised.

Now that we’ve covered the legal changes, let’s look at what this means for HR teams in practice.

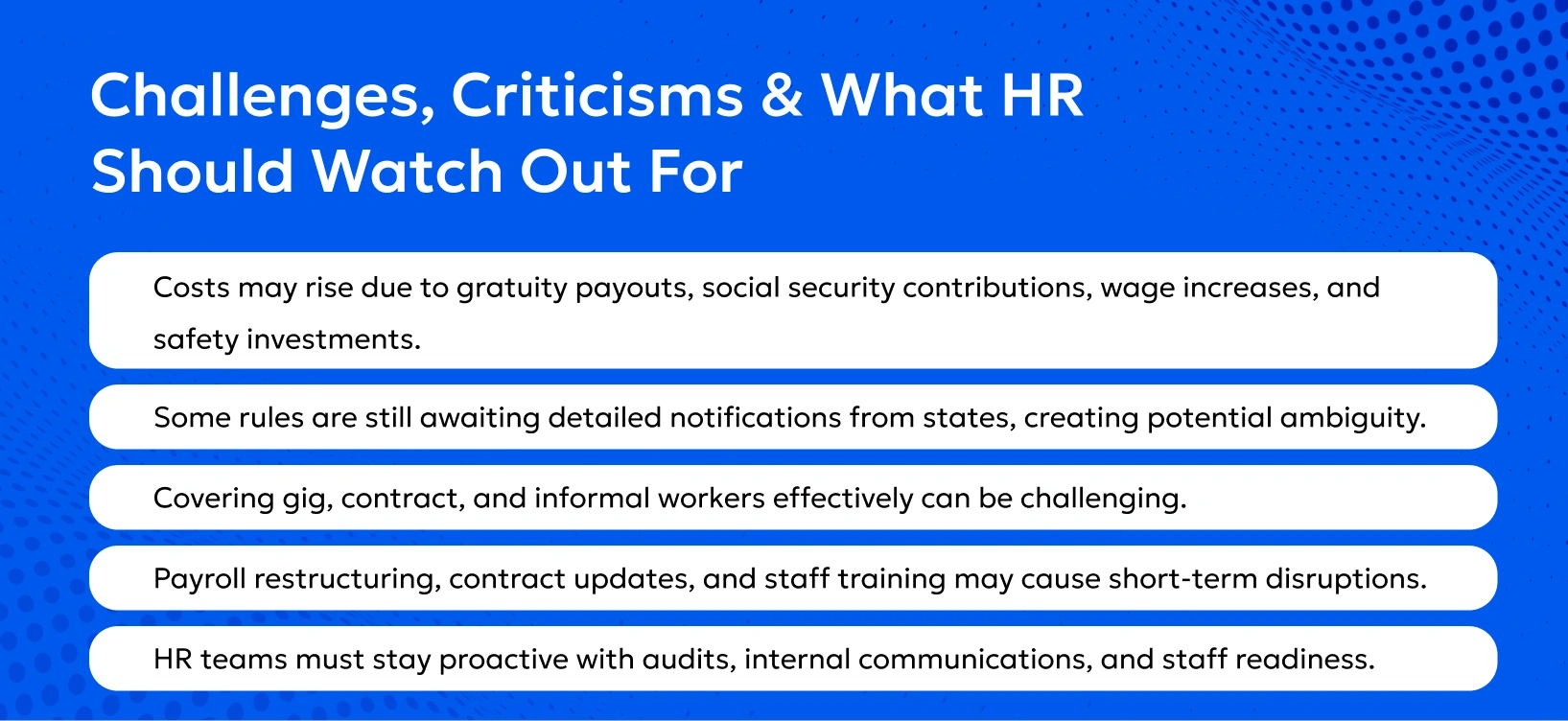

The New labour code in India brings big changes that affect HR and employers. HR teams will need to update policies and systems to stay compliant, while also keeping employees in the loop and protected.

Here’s what the new labour code means for HRs and employers:

At Vishaal Consultancy Services, we keep track of every update under the New labour code in India, so your HR team never misses a critical change. We help you classify employees correctly, review contracts and policies, and guide payroll on wages, gratuity, and social security compliance.

We also support setting up safety, welfare, and grievance systems, so your organisation stays fully compliant while you run your business smoothly and confidently.

Download the official notification here: The New Labour Code in India

The New labour code in India is a landmark reform, consolidating 29 outdated laws into four comprehensive codes effective from 21 November 2025. It simplifies compliance, extends protections, and creates a modern, structured workplace. For HR managers, this is a chance to streamline policies, update payroll, and enhance employee trust while meeting legal requirements.

If you want to stay compliant without stress, Vishaal Consultancy Services can guide your organisation every step of the way. From workforce classification to safety measures, payroll guidance, and grievance systems, we make sure your HR processes are ready for the New labour code in India.

See Related Blogs

BLOGS

Fill in your details to download our exclusive e-learning document.

Fill in your details to download our exclusive e-learning document.

Fill in your details to download our exclusive e-learning document.