Table of Content

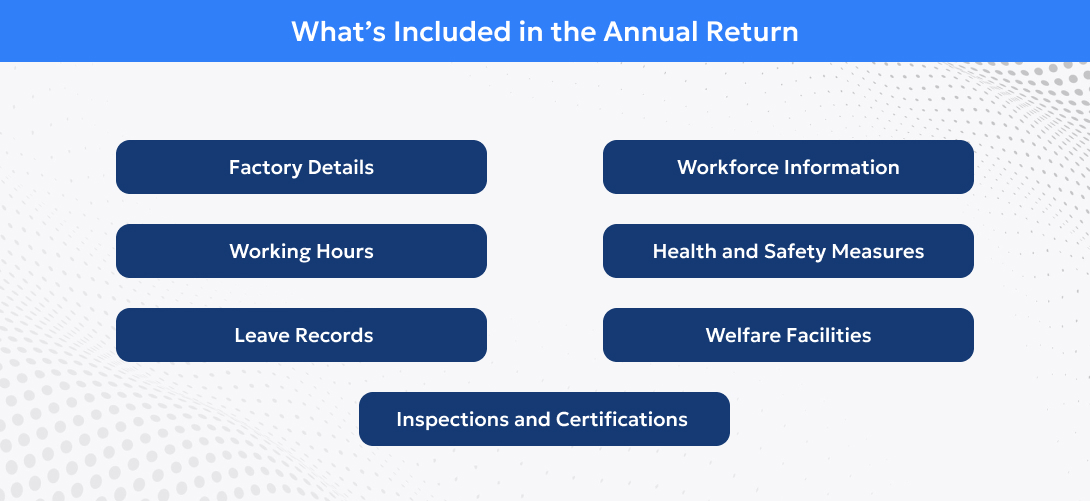

If you run or oversee a factory in India, you have most likely come across the annual return under Factory Act. This is one of those compliance tasks that may seem painstaking and daunting, especially if you are not familiar with the compliance process. But don’t worry, by the end of this blog, you will have a solid grasp of what the annual returns under the Factories Act involve, the filing requirements, the process, and the crucial due dates. Let’s get started!

Having read the blog, the task of filing the annual return under Factory Act might seem daunting, but it’s a non-negotiable requirement and it doesn’t have to be stressful! Vishaal Consultancy Services is here to simplify the process for you.

See Related Blogs

BLOGS

Fill in your details to download our exclusive e-learning document.

Fill in your details to download our exclusive e-learning document.

Fill in your details to download our exclusive e-learning document.